straight life annuity calculator

ImagiSOFT develops Web and Windows insurance and retirement planning software using Microsoft Net technology. An annuity is a fixed sum of money paid someone each period typically for the rest of their life.

What Is A Straight Life Annuity Everything You Need To Know

The Time period during which the asset can be used.

. If youre looking for the best annuity rates and retirement income planning strategies suitable for your lifestyle contact our team of specialists at Income for Life to get started on the right track today. 5000 if the present value of Rs. Currently a male living in the US who is 20 years old has a life expectancy of 77 years and a female can expect to live to be 81 years.

Investing for retirement is an important step to take early on in life. Annuities often come with annual fees as well. 5500 is higher than Rs.

Depreciation Value Straight Line is higher so we switch to Straight Line calculation. Firewood sold in bulk for heating a home generally has several units of measure. All the ones I find dont allow me to alter these part from tax-free lump sum.

Select one of the below calculators in our fun. The VDB function is much more versatile than the DDB function. Useful Life of Asset.

The insurance company will retain the cash value and pay back the premiums to the owners estate. Your life expectancy expressed as an age. Our free online fun calculators are creative tools and calculators that can do everything from calculate how old you are in seconds to show you if you are compatible with a particular person.

Because the annuitization period has not started the owners estate will receive the money paid into the annuity 2. Your retirement funds have to last for your life expectancy minus your retirement age plus one to fund your last year of retirement. In other words when you choose a single life payment you and.

Paycheck Protection Program PPP PITI. 5000 today or Rs. It contains a 6th and 7th optional argument.

Examples of Straight Line Depreciation Formula With Excel Template Lets take an example to understand the calculation of the Straight Line Depreciation formula. Mortgage calculator with taxes and insurance. Whether Company Z should take Rs.

5000 then it is better for Company Z to take money after two years otherwise take Rs. Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments. Some annuities dont qualify for sale.

Which of the following is TRUE. Now in order to understand which of either deal is better ie. If you choose a straight lifetime payout based on one individuals life the payments end when the annuitant dies thats usually you or whoever owns the annuity.

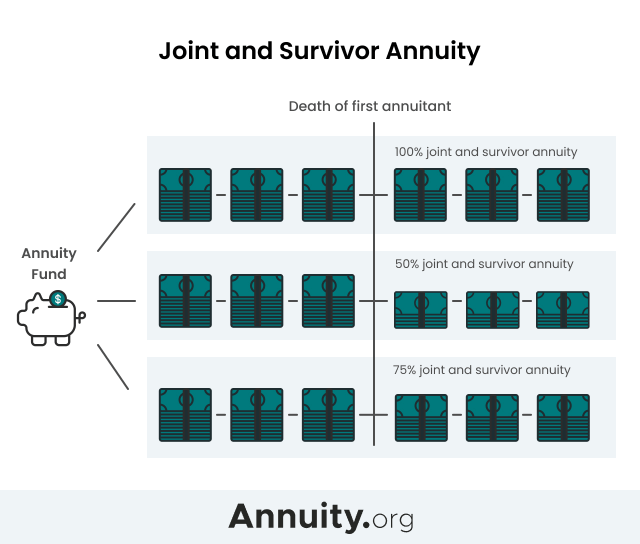

A cord calculator is a helpful tool for any firewood consumer and seller to determine the accurate amount of firewood in a woodpile. I found them years ago but an hour of googling this morning has not given any results. Depending on the contract the annuity may pay 100 percent of the payments upon the death of the first annuitant or a lower percentage typically 50 or 75 percent.

These fees are for managing the annuity and are similar to the administrative fees youd pay for a. In this example VDBCostSalvageLife03 reduces to 2000 1600 1280 4880. 5500 after two years we need to calculate a present value of Rs.

If an annuity is scheduled for 10 annual payments of 10000 each the sum of the payments is 100000. An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. A joint and survivor annuity is an annuity that pays out for the remainder of two peoples lives.

The annuity owner dies while the annuity is still in the accumulation stage. Our products include Electronic Smart forms Term and Universal Life Insurance Illustration Systems Annuity Illustration Software Required Minimum Distributions RMD Stretch IRA 72t Substantially Equal Payments SEPP 403b and 457b Maximum. These cannot be sold because the number of payments is not guaranteed.

It can calculate the depreciation value of multiple periods. More loosely it means any regular cash flow stream which may or may not have an explicit declared term. 5500 on the current interest rate and then compare it with Rs.

I am trying to find an annuity calculator where I can alter variables such as tax-free lump sum singlejoint increase with RPIno increase etc. These include annuities in tax-qualified retirement plans and straight-life annuities which stop paying out at the annuitants death. A portion of each payment is for interest while the remaining amount is applied towards the.

Try out some of our various fun calculators including the horsepower calculator or the MPG calculator or the average speed calculator. After the end of useful life the value of the asset becomes zero. So if youre converting 250000 in assets and theres a 10 fee thats 25000 that goes straight into the brokers pocket.

This vast range of units of measure may include rick or face cord fireplace cord stove cord and firewood cord.

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Formula Calculation Examples With Excel Template

Straight Life Annuity Providing Peace Of Mind In Your Retirement

New York Life Annuity Immediate Annuity

What Is A Straight Life Annuity Retirement Watch

Joint And Survivor Annuity The Benefits And Disadvantages